Ever wondered what it takes to achieve financial happiness? It’s a question that gnaws at many, leading to endless searches for that elusive financial nirvana.

Understanding Financial Happiness

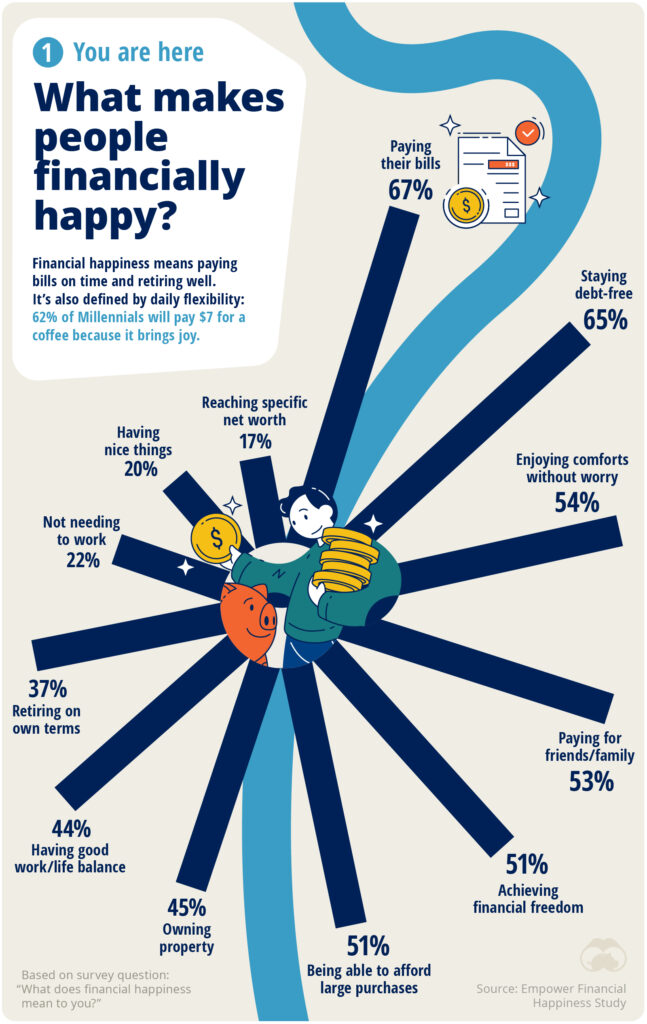

Financial happiness isn’t about a specific net worth; it’s about the freedom that comes from managing money wisely. Think about it: the joy of paying bills on time, staying debt-free and feeling secure in your financial future.

Now, let’s face it, the journey isn’t all roses and sunshine. With inflation and rising costs, it’s like navigating a minefield blindfolded.

And it’s not just about the money – it’s the stress, the anxiety, and the overwhelming pressure that comes with it. From the dread of retirement woes to the fear of job insecurity, everyone’s story has its twists and turns.

Solid Financial Plan: Navigating Economic Uncertainty

But here’s the silver lining – a detailed financial plan. It’s the compass that guides you through the stormy seas of economic uncertainty. It’s not just about budgeting; it’s a holistic approach to your financial life.

Imagine having a plan that aligns with your goals, offering you not just stability but also the confidence to meet your financial goals head-on.

- Setting Realistic Financial Goals

- Goals are the starting point of financial happiness. They provide direction and purpose, helping you focus on what’s important.

- Whether it’s saving for retirement, buying a home, or building an emergency fund, setting clear, achievable goals is crucial.

- Creating a Budget That Works for You

- A budget is a roadmap for your finances. It allows you to track income and expenses, ensuring you live within your means.

- By understanding where your money goes each month, you can make adjustments to save more and spend wisely.

- Building a Robust Savings Plan

- Savings are your financial safety net. They protect you in emergencies and enable you to make big purchases without going into debt.

- Start by saving a small percentage of your income and gradually increase it.

- Investing Wisely for Long-Term Growth

- Investing is not just for the wealthy. It’s a powerful tool for growing your wealth over time.

- Consider different investment options like stocks, bonds, and mutual funds, and seek advice from financial experts to make informed choices.

- Seeking Professional Financial Advice

- Sometimes, managing finances can be overwhelming. Seeking advice from financial planners or advisors can provide clarity, help you avoid common pitfalls, and set you on the path to financial happiness.

And what happens when you reach that state of financial bliss? It’s not just about you. It’s about creating a legacy, living a life of purpose, and being in a position to help others. It’s a change that echoes through your life and into the lives of those around you.

Your Companion on the Road to Riches

Navigating the complex world of finance can be daunting, but you don’t have to do it alone. Seek out expert advice, arm yourself with knowledge, and take that first step towards financial happiness.

Remember, financial happiness is not a distant dream; it’s a tangible goal. With the right mindset, plan, and guidance, you can conquer your financial fears and step into a world of economic well-being.